With all of the uncertainty in the world, economy, and politics, what does it mean when the muni market remains virtually unchanged for 21 days in a row? Either munis are quite confident in themselves or, as we discussed last month, they are in the calm of the storm. Since yields finally changed at month-end, are we exiting the “eye”? There is still no fourth stimulus package, credit downgrades are being announced and here comes the 2020 circus – I mean election.

MainLine is prepared to do some investing if the opportunity presents itself.

In August, MainLine finished an extensive 6+ month review of the possible impact of climate change regarding credit quality and principal protection over the next 30 years for our numerous managed client accounts. This month, we share our findings after reviewing over $400 million in par value with over 1,600 issuers located in 48 states, held in over 80 portfolios. We also share our thoughts on how we plan to minimize the risks, going forward. MainLine wants its investors “sleeping well at night”, even during 120 degree extreme-heat days.

Muni Market Review

September started with yields unchanged during the first 21 days. Spreads started widening at month-end, and then the index yields went higher on the last day of the month. The market may be finally waking up from its summer snooze and exiting the eye of the storm. Highlights as follows:

- High-grade munis were up 2 to 6 bps with the curve steepening, but outperforming taxables. The curve is historically steep from 5 to 15 years, flat from 0 to 5 years.

- Taxable yields were up 1 to 2 bps, curve relatively unchanged.

- Muni issuance continues to be strong year-to-date, and is expected to stay that way.

- YTD supply is up 22% versus 2019. This increase is directly related to the increase in taxable issuance.

- Credit default swap spreads (protection against default) on state general obligation debt increased on average of 150% increase (81 bps) in June (due to COVID concerns), but have now recovered back roughly 30% of the way (23 bps). This shows there is still elevated concern with GO credit quality. The higher credit quality issuers (Florida, Texas, and California) have almost fully recovered, even though they have the worst COVID numbers. Lower-rated states like New Jersey, Illinois have recovered to a lesser degree.

The muni market is moving into a technically weak time of the year, with numerous “grey clouds” on the horizon. MainLine will be on the lookout for an opportunity to do some investing for the Funds and SMA accounts.

Market News and Credit Update

As DC politics continues to pollute the fourth stimulus package, let’s look at the round of budget impacts COVID is having on issuers, taxpayers and the economy.

Round 1 – Cuts in services/jobs: A case study on Minneapolis was published highlighting how the city (AAA credit rated) is looking to plug a $156 million shortfall in tax revenue for 2020 (11.2% reduction). The city has planned to do the following:

- Hiring and wage increase freezes = $29 million savings.

- Reduction in technology projects maintenance, and capital projects = $33 million savings.

- Cuts in non-discretionary spending like training/travel and contracted professional services = $19 million savings.

- Furloughs and firings = $5 million savings.

- Borrow $12 million from the muni market and use of $58 million in cash reserves.

Over $86 million in investment or salaries are now out of the city’s economic base. The multiple for public spending is estimated to be 1.5 to 3 times depending on economic conditions. Assuming the multiple is 2 times, the 11% reduction of revenue ($156 million) is taking out $300 million from a struggling economy.

Round 2: Increases in taxes and fees: New Jersey lawmakers have agreed to raise taxes on the State’s wealthiest. The top tax rate will now be 10.75% versus 8.97% for income levels over $1 million. To be fair, this tax increase is not just due to the loss of revenues from COVID. It is a combination of the State wanting to help the middle and lower class with tax rebates, while adding additional funding to cover a fast growing budget imbalance stemming from recent tax revenue losses.

Round 3 – Government Job Layoffs: New York City Mayor de Blasio has announced the City will be furloughing 9,000 employees to save $21 million. Employees will be required to take 5 days off from October 1 through March. This is just a quick fix and could grow to 22,000 layoffs next year.

Calming Thoughts on Climate Change and Your Portfolio:

Introduction:

Over the last three months, MainLine reviewed and reported to each managed account investor the possible climate change risk in their portfolio and the potential impact it could have on principal protection and credit quality. This review was initiated in late 2019 and put on ice during the muni-COVID market meltdown. Now that it is completed, it is time to aggregate the results, analyze and share what we have learned, and what we plan to do going forward.

Background/Data Reviewed:

- MainLine reviewed over $400 million in par amount, with over 1,600 issuers located in 48 states held in over 80 portfolios.

- 330 bonds were identified as having potential climate change risk that could hurt credit quality and the portfolios’ income level over the next 30 years.

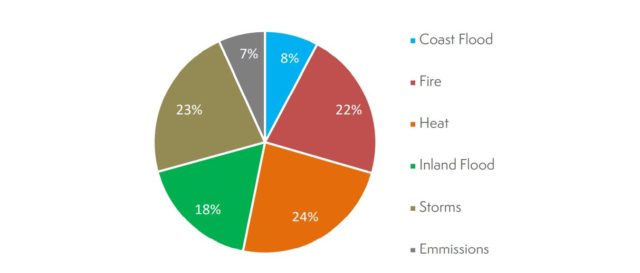

- Of these 330 bonds, the Climate Change risk profile looked as follows:

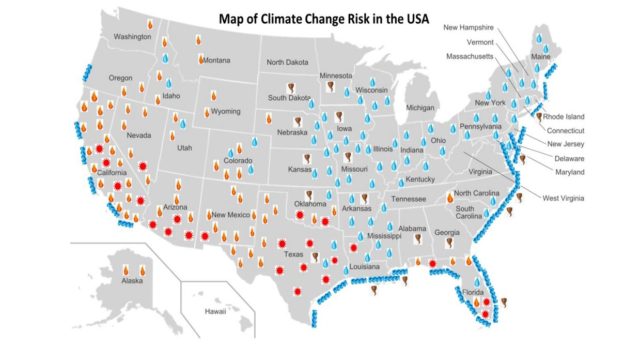

- Of the bonds owned by MainLine clients, extreme heat (24%), exposure to violent storms (23%), and exposure to wild fires (22%) were the most prevalent concerns moving forward with potential climate change. We think much this can be attributed to the geographic location of the issuers and bonds owned by our clients.

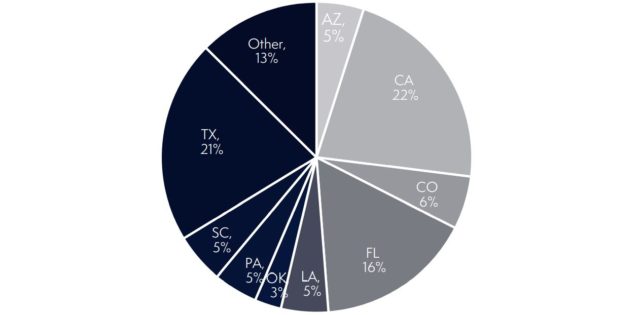

- State break-out on Climate Change risks for the portfolios reviewed are as follows:

- The states with the highest Climate Change exposures listed above helps us understand why the three top risks are so high. California 22%, Texas 21%, Florida 16% are the top three states with Climate Change related risks. Fire & extreme heat are prevalent in all three states and violent storms prevalent in Texas and Florida.

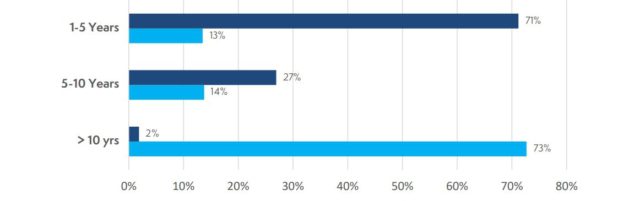

- Below is a graph showing the final maturity and the expected repayment date (includes call date and YTW calculation) for each bond we identified having Climate Change risk.

- Most Climate Change problem bonds have an expected principal repayment date within the next 5 years, due to being called or maturing (71%) limiting Climate Change risk going forward. Only 2% were expected to be outstanding for over 10 years. These results are not reflective of Climate Change risk, but are more about the repayment ladder of the clients’ portfolios. It does help reduce it though, as Climate Change is a bigger risk in 30 years than it is in 5 years.

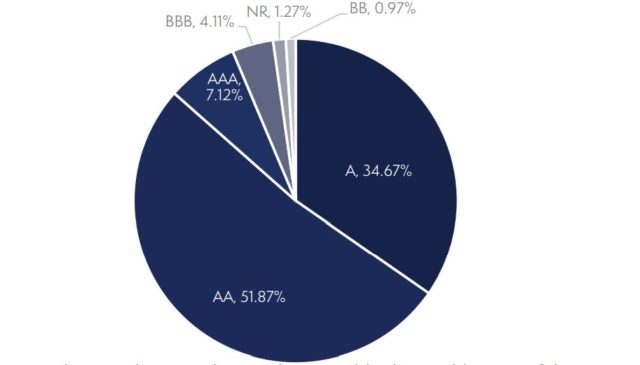

- Below shows the credit ratings of the bonds we identified as having Climate Change risk:

- The data shows, Climate Change risk is credit-rating blind. Roughly 59% of the issuers with Climate Change risk are top tier in credit quality (AAA & AA rated), and of the remainder most are A-rated at 35%. This is a good credit profile for the issuers and reflects no concern for repayment at this time. It also provides a filter going forward for the ability an issuer can manage and afford Climate Change risk.

Conclusions

What does all this mean regarding your Portfolio and the Climate Change risks identified?

- Those bonds with risks that exceed 5 years and are providing essential services in areas of wealth, solid demographics, and good credit ratings are on a list to be monitored with minimal Climate Change risk, going forward.

- Those bonds with Climate Change risks that are not providing an essential service, weak demographics and not top tier credit ratings, were also placed on a list to be monitored going forward for Climate Change risk. We may recommend selling these bonds at some point if the Portfolio has a need for cash or Climate Change risks get worse. MainLine has already sold some Climate Change risk bonds in a few liquidations this summer where we prioritized Climate Change. Bids for these bonds did not reflect a price discount attributable to the perceived Climate Change risk we saw for the issuer. They also met with the objectives of the sell program.

Going forward, there are some strategies to minimize Climate Change risk and its impact on your portfolio’s income level and credit quality:

- Limit investing in issuers located in high-risk states with low to no state income tax. This works for residents of Texas, Florida, and Arizona, but not well for California. If purchasing an issuer in high Climate Change risk states they should be a top tier credit issuer providing an essential service in a demographically strong area. The issuer should be located in an area where the resources and willingness exist to maintain or rebuild the project if it is destroyed or damaged.

- Those issuers with multiple Climate Change risks should, most likely, be avoided. The odds that one of the risk influences operations and finances far greater.

- As long as Climate Change risk is not priced into the muni market, MainLine will look to sell Climate Control risk bonds first when raising cash for clients –or- looking to execute income enhancement trades, especially if the bonds meet with the objectives of the requested liquidation.

- MainLine continues to believe the top investment objective is to have your Portfolio be a “sleep well at night” source of income. This means today and in 30 years, if there are changes in the climate. MainLine does not want its client to have problems sleeping, even in 120 degrees of extreme heat.

View the Monthly Review PDF here.

This document is for informational purposes only and is summary in nature. It does not contain all material information and considerations relevant to an investment in MainLine West Tax Advantaged Opportunity Fund IV LLC (“The Fund”). No representations or warranties express or implied, are made as to the accuracy or the completeness of the information contained herein. Any prior investment results presented herein are provided for illustrative purposes only and have not been verified by a third party. Further, any hypothetical or simulated performance results contained herein have inherent limitations and do not represent an actual performance record. Actual future performance will likely vary and June vary sharply from such hypothetical or simulated performance results. This document does not constitute an offer to invest in securities in the fund. No offer of securities in the fund can be made without delivery of The Fund’s confidential private placement memorandum and related offering materials. An investment in securities of The Fund involves risk, including potential risks that could lead to a loss of some, or all, of one’s capital investment. There is no assurance that the fund will achieve its investment objective. Past performance does not guarantee future results. There can be no possibility of profit without the risk of loss, including loss of one’s entire investment. There are interest and management fees associated with an investment in The Fund which are disclosed in The Fund’s offering materials.