Munis are starting to show their soft side again and MainLine thinks this is just the beginning. Going forward, technicals are weak, credit downgrades are starting to finally appear, politics are stalling the fourth stimulus package targeted to help municipalities, and the 2020 election is stumbling into focus.This month, we look ahead at the elections in November and their impact on the muni market. Clearly, the chaos surrounding election season is a separate matter and creates additional concerns for munis. While it is clear (regardless of who wins) that chaos is brewing, we will focus on policy changes and their impact on the municipal market.

Muni Market Review

August started showing the “softer” side of munis. Technicals are weakening, patience for the fourth stimulus package that is supposed to help munis is waning, issuance is increasing, and yields are rising after US Treasuries sold off due to a higher inflation outlook. Highlights as follows:

- High-grade munis were up 3 to 19 bps with the curve steepening, but outperforming taxables.

- Taxable yields were up 8 to 32 bps, also with the curve steepening.

- Muni issuance has been strong year-to-date, in light of the market meltdown in March/April and budget concerns going forward:

- YTD supply is up 21% versus 2019.

- Taxable munis represent 29% of the issuance,up from 11% in 2019. This represents the increase in issuance year-to-date; tax-exempt issuance is unchanged.

- Credit default swap spreads remain elevated from pre-Covid levels, showing investors are not quite convinced things are ok in muniland.

Technicals are now turning negative for munis over the next 30 to 90 days. We continue to assess the return of the final third of the deleveraging capital for Fund V, Fund VI stays on the alert for any new “COVID-infected” investment opportunities, and subscriptions for Fund VI.5 are now being accepted.

Market News and Credit Update

- New Jersey’s “Baby Bonds”. The Governor has introduced an idea to provide all newborns a $1,000 deposit for families that earn less than $131,000 a year. The idea is to provide funds for higher education and ultimately help narrow the wealth gap in the state. It is unclear what the investment yield would be -US Treasuries or state general obligation bonds? Given the current level in yields, the $1,000 could grow to $1,400 in 18 years. Alternatively, let us assume it will be invested in the stock market, and returns are on average 8%. This would provide $4,100 in tuition aid in 18 years. I like the idea and effort, but I do not think this plan will fix the wealth gap. Maybe the name “baby bonds” implies to the small impact it will have.

- August is bringing us a reminder of the possible consequences of climate change on the environment and on muni issuers. Historic fires in California, hurricanes in the panhandle of Texas, are here now and are expected to get worse in time due to CC. MainLine has been providing a review of its investors’ bonds and exposure to CC in their recent semi-annual reviews.

- Looking for a cheap mass transit project to purchase? The bankrupt Las Vegas monorail is for sale at 4 cents on the dollar. At an original cost of $650 million (yes financed with muni bonds), the city is contemplating buying it at $24.3 million. Perhaps if you step up the bid to $25 million you can get a free breakfast buffet coupon.

- Fund IV was fully terminated after 4¾ years and proceeds were sent out. Total return was 10.83%, cash payout since inception of 6.54% and a tax equivalent total return of 15.32%. We are currently taking subscriptions for a quick start-up Fund VI.5 over the next 30 days. Please contact us for more information.

Munis and the 2020 Election:

It is a little early, and not my style to predict or express my opinion on the outcome of the elections this fall, but what we can do is look at the possible outcomes and their impact on the municipal market.

Three scenarios seem likely at the moment and in no particular order:

- Trump President and split Congress

- Biden President and split Congress

- Biden President and a Democratic Congress

The first two scenarios do not really have much of an impact, policy wise, on munis and we would expect no change in muni value or market demographics.

Scenario #3 could have munis winning the lottery. The Democrats’ game plan is municipal market friendly. If they control the White House, and Congress, the following could become a reality:

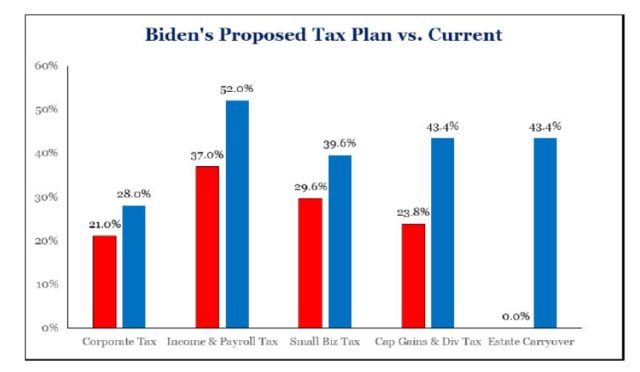

- Increase in taxes across the board. This will be needed to fund new programs including the cost of climate change policies. An increase in taxes will increase the value of tax-exempt income and make municipal bonds more valuable.

What does a 52% top income tax mean to a muni bond’s yield? For example, using a 3% yield -the after-tax equivalent yield today is 5.06% (37% income tax + 3.8% Medicare tax). In a 52% top income tax world, the tax-equivalent would be 6.78%. This, of course, would not be the actual outcome. In reality, muni yields would drop to create the same tax-equivalent yield, which means the 3% yield on the bond would become 2.25%. This, ultimately, equates to a built-in 75 bps rally and a 27.8% return on a 4% coupon 20-year final maturity, 10-year callable bond.

- Repeal SALT (No longer limit the state and local tax deduction to $10,000) and keep the wealth from leaving the high tax blue states such as California and New York. This exodus is going to hurt these states financially in the years to come. This policy change would actually hurt the value of municipal bonds in high income tax states. They will no longer trade as rich versus the general market index.

- Infrastructure project as part of a bigger stimulus package. This program has been estimated at roughly $1.43 billion to replace and repair infrastructure across the country. How would this be financed? Possibly the rebirth of the Build America Bond program, with issuers selling taxable bonds and getting a subsidy from the US Government. We feel this, with a few changes from the original program in the 2009 American Recovery and Reinvestment Act, is an efficient and accountable way to finance infrastructure.

- Repeal the ability to tax advance refund, which was taken away from municipalities in the 2017 Tax Act. Municipalities have been advance refunding since this repeal with taxable bonds, decreasing the supply of tax-exempt bonds, and ultimately increasing the cost of the debt to municipalities.

Conclusion:

What does all this mean? We will see more munis, lower yields, and an increase in your portfolios value if the Democrats win. If the Republicans win, we will see a status quo for munis.

As they say in the muni world, if you want to live like a Republican and secure your own wealth in society, you need to vote like a Democratic.

Or, if you are not a fan of either party, may I offer you another option I know you can trust? I’m just not sure how to vote for it…

View the Monthly Review PDF here.

This document is for informational purposes only and is summary in nature. It does not contain all material information and considerations relevant to an investment in MainLine West Tax Advantaged Opportunity Fund IV LLC (“The Fund”). No representations or warranties express or implied, are made as to the accuracy or the completeness of the information contained herein. Any prior investment results presented herein are provided for illustrative purposes only and have not been verified by a third party. Further, any hypothetical or simulated performance results contained herein have inherent limitations and do not represent an actual performance record. Actual future performance will likely vary and June vary sharply from such hypothetical or simulated performance results. This document does not constitute an offer to invest in securities in the fund. No offer of securities in the fund can be made without delivery of The Fund’s confidential private placement memorandum and related offering materials. An investment in securities of The Fund involves risk, including potential risks that could lead to a loss of some, or all, of one’s capital investment. There is no assurance that the fund will achieve its investment objective. Past performance does not guarantee future results. There can be no possibility of profit without the risk of loss, including loss of one’s entire investment. There are interest and management fees associated with an investment in The Fund which are disclosed in The Fund’s offering materials.