Monthly Muni Credit Review June 2020 –Summer Heat, Climate Change and Your Muni Bonds

The summer heat has munis performing as if things are all ok -and “no worries man”. The muni market general index was unchanged, looking like a market with no concerns. The real price action has been in the high-yield market and with once infected COVID issuers and sectors. States like Illinois, New Jersey, and sectors such as airport bonds have had credit spreads tighten from 25% to 50% (55bps to 205 bps) over the last 30 days (or since their highs). We remain diligent with the Opportunity Funds, selling when we get the opportunity, returning deleveraging capital, and waiting for new COVID-related opportunities to invest further.

This month’s credit review is the release of our six-month climate change review of MainLine West investor bonds. It has taken many work hours, help from our intern, Rick Roth (until the COVID quarantine sent him home) and several interactive maps and what-if scenarios to complete this project. The process we took in this extensive review is highlighted in this month’s credit review. Each MainLine investor will get a detailed personal report on their holdings in their semi-annual report over the next three months. Hope you find the analysis as interesting and meaningful as we did.

Muni Market Review:

June was a sleepy and uneventful month for the general muni market, except for the high yield market and COVID-infected sectors; for these issuers it was a big month of outperformance. The virus continues to spread and the economic fallout debated, but the muni market is in denial that it will have a long-term impact. The summer heat must be getting investors light-headed. Will muni investors make the same mistake twice? Highlights as follows:

- High-grade munis were mixed along the curve, 3 bps higher for 5-year bonds, unchanged for 10-year bonds, 4 bps lower for 25-year bonds. A slight flattening of the curve.

- Taxable yields were also marginally changed at lower by 3 to 1 bps, also with a slight curve flattening.

- Credit yield spreads on “COVID-infected “ states and sectors have tightened dramatically over the last month and since their highs :

- Illinois has tightened 32% or 205 bps

- New Jersey has tightened by 27% or 55 bps

- Airport bonds on average have tightened 55% or 74 bps

Technicals are positive for munis to continue to do well for the next 30 to 60 days. We recently returned a third of the deleveraging capital for Fund V and are assessing to return the next third in July. Fund IV liquidated another portion of its portfolio and is now roughly 67% executed; we will continue to look for opportunities to sell more holdings. Fund VI stays on the alert for any new “COVID-infected” investment opportunities, but it could be a short while until munis cool off from the summer heat.

Market News & Credit Update:

It is hard to fathom the fourth stimulus package will not have $1 trillion of aid to municipalities.This will help soften the pending increase in taxes and cuts in services. It should also be complemented with an Infrastructure program to encourage projects. At this moment, municipalities will be dedicating monies to fund health costs and other COVID-induced expenses and not infrastructure. An infrastructure program, with a healthy subsidy to municipalities, will provide jobs, economic activity and allow municipalities to move forward with projects, helping the economy recover.

The incredible shrinking muni bond underwriting business. Since 2013, the number of underwriting firms has dropped 40% from 147 firms to 91. This comes during a period where issuance has been high and the top underwriters continue to increase their market share (top 10 underwrite 91% of the deals). Why has this happened? One reason is profit margins are lower, but we feel the biggest cause for this consolidation are the new regulations that have made things more complicated and costly. This decrease in competition is not a good trend for issuers or investors and, once again, reflects what happens when big government tries to fix a problem that never really existed in muniland.

Thank you for your interest in a new Fund! MainLine is in the process of doing a quick capital raise for Fund VII. We are roughly 70% invested for Fund VI, but feel the muni market remains vulnerable and further investment opportunities will exist. We have had some current investors and some new investors express interest in our investment strategy, and we are optimistic the opportunity will exist again this fall. Please let us know if you have interest in Fund VII. We see a capital-raising period over the next 60 to 90 days.

Introduction to Climate Change and Your Municipal Bonds:

At MainLine, we are focused on the forecasted impact of climate change and its potential impact on issuers and sectors of the municipal market. We acknowledge this risk is long-term and is debatable. Yet, at this moment, the muni market does not price differentiate between credits and sectors regarding their risks associated with Climate Change. We feel, at some point, there could be a devaluation in the price of “unfriendly CC bonds” versus the “friendly” ones. This means MainLine views this is as a good time to review your current holdings and make any changes (with your approval) at no cost to your current level of income, before there could be a market impact.

Depending on who you listen and talk to, some of the issues below are already happening because of the increase in the average temperature around the world. In general, the prospects of the earth increasing on average by two degrees could create numerous adverse municipal credit issues. We reviewed each bond and their possible credit ratings and expected principal protection ability if the following issues occur over the next 30 years:

- Coastal Flooding

- Increased wild fires and mudslides

- Higher temperatures and humidity

- Inland flooding

- More violent, less predictable weather patterns

- Emission control and costs to fix

MainLine will summarize the findings of our CC review in your semi-annual review over the next three months. This review will highlight any concerns we have with an issuers credit quality ratings, and principal repayment ability, going forward. Then, we will put forth a recommendation, either to hold and monitor –or-sell the bond. We aim to make your White SWAN portfolio a Green one, at no additional cost.

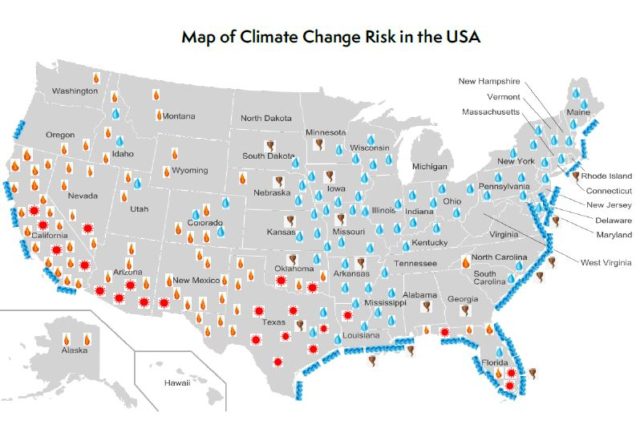

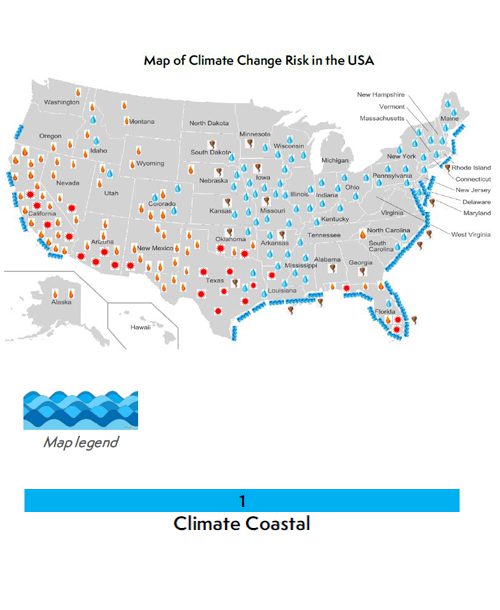

Climate Coastal:

Climate Coastal:

An interactive map on the sea level rise and coastal flooding from the National Oceanic Atmospheric Administration was used for this analysis. We assumed 2 feet of flooding, which is what experts predict will be the rise in ocean sea levels by the year 2050. We then looked to see which issuers would have problems with coastal flooding. In affected areas, we then looked at the essential nature of the bond’s project and the ability and willingness of the issuer to support it.

The states listed below are those that have potential coastal flooding risk:

- California

- Connecticut

- Delaware

- Florida

- Georgia

- Louisiana

- Maine

- Maryland

- Massachusetts

- Mississippi

- New Jersey

- North Carolina

- Oregon

- Rhode island

- South Carolina

- Texas

- Virginia

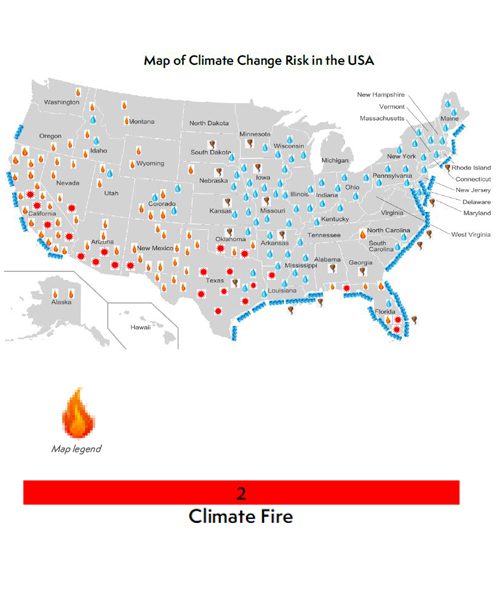

Climate Fire:

An increase in average temperature leads to more and larger wild fires, which can also lead to more mudslides. These fires can also further pollute the air with carbon emissions and other toxic pollutants. A region prone historically to wild fires will be more susceptible to them with CC. These fires will also create greater harm to the issuers’ economies, tax bases and increase costs to rebuild. We used a map from the US Forest Service that shows the degree of fire risk in the USA.

This map is from historical fire history and the potential for the conditions to exist, going forward. Those issuers with a high degree of fire risk were then further analyzed as to the essential nature of the bond’s project and the ability and willingness of the issuer to rebuild or protect it.

The states listed below have the potential, given history, to have wild fires in the future:

- Arizona

- California:

- Colorado

- Florida

- Idaho

- Montana

- Nevada

- New Mexico

- North Carolina

- Oklahoma

- Oregon

- Texas

- Utah

- Washington

- Wyoming

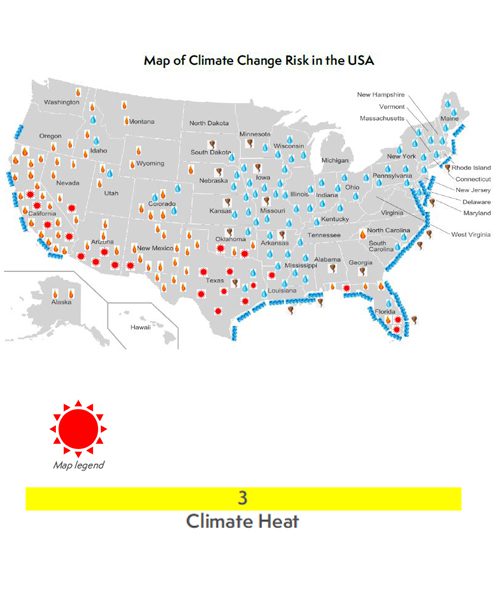

Climate Heat:

An increase in temperature and humidity can have an impact on living standards, work productivity and, therefore, the economy and tax base of an issuer. Using an interactive website from the Union of Concerned Scientists, we identified the number of days of “Extreme Heat” (2 to 3 days with the heat and humidity that the body has to work hard to maintain not dying from). It also shows the number of days with 100+ degree temperatures for various time periods in the future. We focused on the estimated average extreme heat day occurrences from 2036-2065. We viewed over 100 days (27%) for an issuer as having a possible adverse impact on it’s economy and tax base. We then further analyzed these issuers to see what the effect would be on local industry and population.

States listed below have the potential for numerous “extreme heat” days, going forward:

- Arizona

- California

- Florida

- Louisiana

- Nevada

- New Mexico

- Oklahoma

- Texas

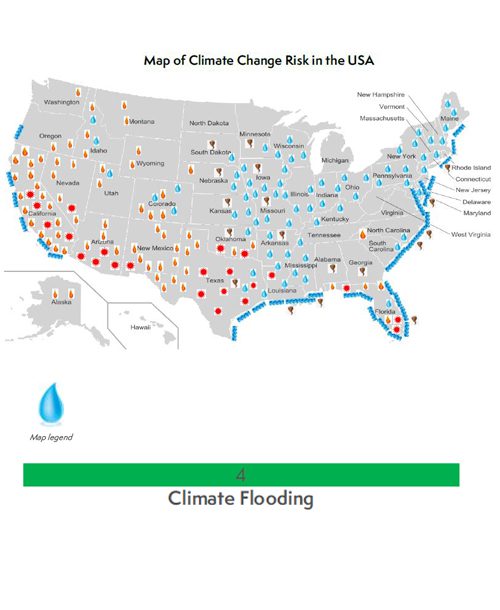

Climate Flooding:

Using a map from FM Global, we isolated the regions of the country historically prone to flooding. The map categorizes flood risk as high, moderate, or none for the entire USA. Climate change is forecasted to create more frequent and violent storms, causing more severe flooding.

Those issuers in the areas categorized as high flood risk were then further analyzed as to the ability of the issuer to recover, essential nature of the project and the impact on its economy and the tax base, going forward.

The states listed below are those identified as having a history of flooding:

- Arkansas

- Colorado

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maine

- Massachusetts

- Maryland

- Mississippi

- Nebraska

- New Jersey

- New York

- Ohio

- Oklahoma

- Pennsylvania

- South Dakota

- Texas

- Wisconsin

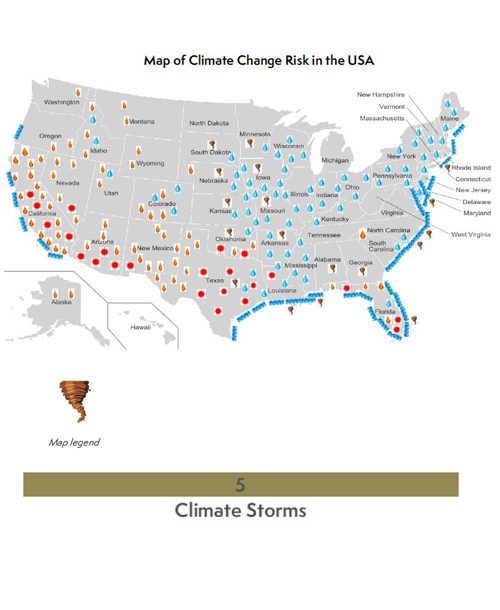

Climate Disasters/Storms:

As the climate changes, there is estimated to be an increase in the number of hurricanes and tornados, along with an increase in their strength and ability to cause more damage.

We isolated where these storms have historical occurred by using an interactive map from National Oceanic Atmospheric Administration for hurricanes, and Midwestern Regional Climate Center for tornado tracking. Those issuers located in these storm zones were the then analyzed as to their ability (cost) and need to rebuild if the issuer was severely impacted by a natural disaster.

The states listed below are those identified as having a history of climate disasters/storms:

- Arkansas

- Alabama

- Connecticut

- Florida

- Georgia

- Iowa

- Kansas

- Louisiana

- Maryland

- Massachusetts

- Minnesota

- Mississippi

- Missouri

- North Carolina

- Oklahoma

- Rhode Island

- South Dakota

- South Carolina

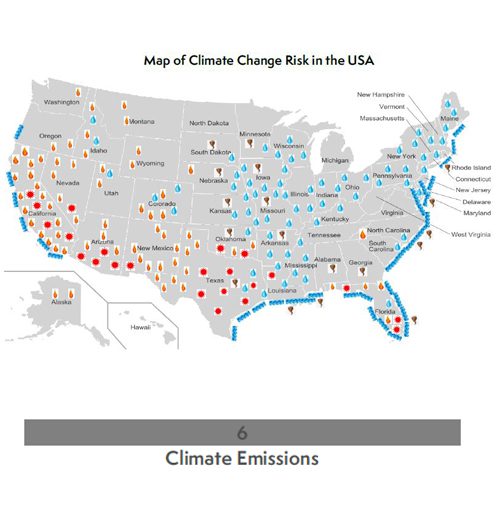

Climate Emission:

We focused on those power utilities that are reliant on coal as a major source of energy. Every electric utility issuer was reviewed independently. Those that rely on coal were then analyzed further to see if they were working towards converting to a cleaner source of energy and if they have the cost structure to absorb this new technology and meet lower emissions standards going forward.

The assumption is that no state in the USA is not prone to this risk. It is a specific issuer risk.

Conclusions:

What, specifically, is MainLine going to do about CC and the municipal portfolio we are managing for you and our Fund investors? We will turn your Portfolio “green” by doing the following:

- New Purchases: We will review every new bond for CC risk today and over the next 30 years. As we make buying decisions, we will keep in mind the expected repayment date and diversification factors in the portfolio.

- Current Holdings?In your Semi-Annual Report over the next three months, MainLine will review each of your bonds for CC risk, share our findings, and advise from there. If we find issues, we may recommend selling bonds, or holding if we feel the expected repayment date is soon enough or the concern is not big enough at this time. As we go forward, we will continue to monitor CC risk with each Semi-Annual Review.

Whether you agree or not with CC and the urgency, it seems safer to address these issues sooner rather than later. The risks of being wrong are too great and the current cost to fix things is nothing. It’s about keeping our investors “Sleeping Well at Night”.

View the Monthly Report PDF here.

This document is for informational purposes only and is summary in nature. It does not contain all material information and considerations relevant to an investment in MainLine West Tax Advantaged Opportunity Fund IV LLC (“The Fund”). No representations or warranties express or implied, are made as to the accuracy or the completeness of the information contained herein. Any prior investment results presented herein are provided for illustrative purposes only and have not been verified by a third party. Further, any hypothetical or simulated performance results contained herein have inherent limitations and do not represent an actual performance record. Actual future performance will likely vary and June vary sharply from such hypothetical or simulated performance results. This document does not constitute an offer to invest in securities in the fund. No offer of securities in the fund can be made without delivery of The Fund’s confidential private placement memorandum and related offering materials. An investment in securities of The Fund involves risk, including potential risks that could lead to a loss of some, or all, of one’s capital investment. There is no assurance that the fund will achieve its investment objective. Past performance does not guarantee future results. There can be no possibility of profit without the risk of loss, including loss of one’s entire investment. There are interest and management fees associated with an investment in The Fund which are disclosed in The Fund’s offering materials.