May 2020 –“Munis’ COVID-19 Vaccination”

We welcome back summer and we welcome back the municipal market. There was not one negative price day for the month of May. Add to it a return to positive cashflows into muni funds, a renewed appetite for credit risk, and a lower than average May issuance of bonds and you get a muni market vaccine for the COVID-19. There remain sectors and issuers that have not fully recovered (pre-existing credit health conditions), but the majority of high grade and essential service bond yields are back in full tax-exempt bloom. MainLine West and the Family of Funds will be on alert for the summer looking at opportunities to sell (Fund IV), return deleveraging capital (Fund V) or buy (Fund VI). However, MainLine thinks there is a good chance munis will struggle again this fall after a wonderful summer.

In this month’s credit review, we look at what state and local governments are most likely to do to balance their budgets, after an estimated average 10% to 20% decrease in tax revenues over the next three years due to COVID-19. Yes, we anticipate credit downgrades. Yes, we anticipate ugly and disrupting cuts in services. Yes, we anticipate new taxes and fees. However, when the virus and the political crisis clear, do not underestimate the resiliency of a white SWAN (sleep well at night) investment strategy.

Muni Market Review

In May, the muni market made a “V” shaped recovery. The high-grade market has fully recovered from the COVID-19, or was it just the flu? After a big move down in rates during the month, munis are roughly back to even from the losses in March and April. Highlights as follows:

- The short-end has positive returns on the year at 2% to 3% after increasing by 1.5% to 3.00% for the month. The long-end was up 5% for the month, and is now up 4% on the year. More specifically, during the month of May:

- Muni yields are lower by 71 bps on the short-end, 63 bps lower on the long-end.

- Taxable yields were lower 16 bps on the short-end, up 9 bps on the long-end.

- Munis outperformed on the short-end by 55 bps and on the long-end by 72 bps. This change in the muni yield ratio helped the Funds post good return during the month.

- Supply is up versus 2019 (10.7%), but for the month of May down by 4%. Analysts are expecting the pace to pick up over the summer months.

- Every week in the month of May, the ICI Municipal Fund Index showed inflows for the bond funds. The inflows roughly offset the outflows in April, but hardly make a dent into the outflows in March (9% off settled).

MainLine feels good about the positive direction of the muni market for the next 60 to 90 days. We are still worried about the fall, given the political tensions, the election, still evolving economic fallout and the possible second wave of the COVID-19. Until then we will be assessing the ability to return deleveraging capital for Fund V, an additional liquidation of Fund IV, and on the alert for undervalued issuers and sectors for Fund VI. So much for a quiet summer at MainLine West.

Market News and Credit Update

- Technicals for the next 90 days look bullish for munis. The demand (maturity and coupon payments) exceed the supply (anticipated new debt issuance) by $52 billion. This estimate shows that supply will only fill 70% of the demand. This seasonal trend should help munis to continue to outperform this summer.

- Municipalities will need to find a way to fill the budget deficit created by the COVID-19. One way to do this will be to create new taxes. Here are two new taxes we think could become popular:

- Louisiana just approved the Marketplace Tax, with only four other states collecting it. The marketplace tax is a tax on third party transactions that are collected from a marketplace facilitator (like Amazon) from the business selling it. This could provide a good source of income and is aligned with evolving consumer behavior trends.

- Chicago’s has a tax on streaming services such as Netflix, Hulu, Spotify and on-line ticket sales that is called the Amusement Tax. The tax is 9% on monthly subscriptions or on transactions. It is not a big revenue earner at this time, but it is aligned with evolving consumer behavior trends.

- The State of Illinois is the first to use the Fed’s $500 billion line of credit available for muni issuers, borrowing $1.2 billion at a 3.85% for one year. The State is struggling and having to pay 3.85% is a lower rate than available from the public markets. We do not see many other muni issuers using the Fed to help fund their operations. For example, if a AAA-rated issuer wanted to borrow from the Fed, they would pay a 1.50%. Current 1-year new issued AAA-rate bonds yield .16%.

The COVID-19 Budget Hole Immunization:

Introduction:

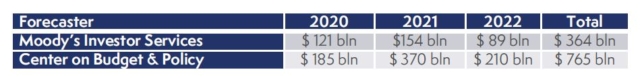

The lockdown and current economic fallout has left a big hole in state and local government budgets. Estimates vary, but all point to a challenge for issuers to find ways to balance the 2020, 2021 and 2022 budgets. Tax revenue decline estimates are as follows:

There is quite difference between estimates; it is simple to say we do not know the exact amount yet. What we do know is, on average, there is a 10% to 20% per year budget hole to be filled by state and local governments. To put this in other terms, the Federation of Tax Administrators is estimating a $152 billion hit in 2020, with the following percent changes in revenue type:

- Income tax down $83 bln, 22% decrease from 2017.

- Corporate tax down $24 bln, 10% decrease from 2017.

- Sales tax down $38 bln, 45% decrease from 2017.

This is not the first time state and local governments have had to find ways to balance their budget and pay their bills. They went through the same process after 2008 economic crisis. This may ultimately be a bigger deficit to make up than 2008, but issuers still have numerous corrective actions that can be implemented:

- Cuts in services are painful, but will necessary and likely will be the most used corrective action to fill the COVID-19 hole. A state can cut funding to itself or localities (cities, counties) and, as a result, services are cut. Examples of these painful cuts would include school funding, employment of police, fire and government workers.

- Federal aid and other stimulus measures are what investors and residents should be hoping for to fill the budget gap. This will soften the cuts in services or increases in taxes/fees, giving the municipalities time to grow out of their problems.

- The ability to increase tax rates, service feesand/or find ways to broaden the current tax base. This allows a municipality to increase revenues for the current year and beyond. Municipalities can also create new taxes/fees. In the credit review section above, we reviewed two new taxes we feel could become popular: The Marketplace Tax and the Amusement Tax.

- Borrowing or assuming funds from other related governmental agencies where balances exist and can be transferred to the general fund. For example, if there is extra money from the state’s gas tax in the transportation fund, the state will transfer it to the general fund to balance state operations.

- Selling municipal?owned assets such as turnpikes, bridges, parks, parking operations, lotteries and liquor stores to private investors for cash. This has been done before, and is currently being explored by numerous budget-tightening municipalities. There appears to be capital willing to invest in these types of assets, which can provide funds to municipalities for immediate fiscal relief.

- Growing out of the problem. This is a longer-term solution which, coupled with other policy actions above, can help soften the pain of current actions. As population grows, so do tax revenues.

Conclusion:

We anticipate credit downgrades, we anticipate ugly and disrupting cuts in services, and we anticipate new taxes and fees. We also anticipate defaults for investment grade essential service municipal bonds will remain extremely low , as they did during the 2008 banking and economic crisis (.03%). Do not underestimate the calmness of a white SWAN investment strategy.

View the Monthly Report PDF here.

This document is for informational purposes only and is summary in nature. It does not contain all material information and considerations relevant to an investment in MainLine West Tax Advantaged Opportunity Fund IV LLC (“The Fund”). No representations or warranties express or implied, are made as to the accuracy or the completeness of the information contained herein. Any prior investment results presented herein are provided for illustrative purposes only and have not been verified by a third party. Further, any hypothetical or simulated performance results contained herein have inherent limitations and do not represent an actual performance record. Actual future performance will likely vary and June vary sharply from such hypothetical or simulated performance results. This document does not constitute an offer to invest in securities in the fund. No offer of securities in the fund can be made without delivery of The Fund’s confidential private placement memorandum and related offering materials. An investment in securities of The Fund involves risk, including potential risks that could lead to a loss of some, or all, of one’s capital investment. There is no assurance that the fund will achieve its investment objective. Past performance does not guarantee future results. There can be no possibility of profit without the risk of loss, including loss of one’s entire investment. There are interest and management fees associated with an investment in The Fund which are disclosed in The Fund’s offering materials.