The Eye of the Muni Storm:

We see the current state of the market reflected by the calm and resilient nature of muni prices at the center of an economic and health crisis.

MainLine believes there is still more “bad weather” to come in muniland, as the economic and political fallout of the virus and the election play out this fall. As of the end of July, munis are at all-time low yields and daily volatility is absent.

July was a good month in muniland, as fund flows stayed strong and (year-to-date) are positive, having fully offset the huge outflows in March and April.

Credit yield spreads on “COVID-infected” states and sectors remain the major force behind muni performance and have recovered roughly 70% of their pre-COVID yield spread levels. We see munis continuing to impress for the next 30 days, as technicals remain solid. However, start restocking on toilet paper, wipes and masks as the other side of the COVID Muni Storm returns.

Muni Market Review

July was another good month of healing for the muni market and was even better for the scarred high-yield issuers and COVID-infected sectors. Munis outperformed taxables and are now at all-time low yields. Highlights as follows:

- High-grade munis were down 18 to 24 bps with the curve flattening 6 bps. From 2 to 20 years, muni yields are at their lowest levels ever versus historical levels since May 1991.

- Taxable yields were also down by 8 to 15 bps, also with a slight curve flattening. Taxable yields from two to 15 years are also at their lowest historical levels since May 1991.

- Fund inflows remain strong in combination with strong seasonal technicals. Now, flows on the year are positive, more than offsetting the huge outflows in March and April.

In August, there is an estimated $22 billion of payments from maturities/calls and coupon payments with only $10.7 billion on the current 30-day supply calendar. We believe the calendar will grow, but there is still a bullish demand tone to munis. - Credit yield spreads on “COVID-infected” states and sectors remain the major force behind muni performance. We estimate, from their high yield spread levels to the AAA-curve versus the original spread pre COVID, these infected issuers are 70% recovered.

Technicals are positive for munis to continue to do well for the next 30 days. We returned another third of the deleveraging capital for Fund V and are assessing the return of the final third. Fund IV continues to look to liquidate and we feel there is a good chance this will be executed in the next 30 days. Fund VI stays on the alert for any new “COVID-infected” investment opportunities, but it could be a short while until muni value returns.

Market News and Credit Update

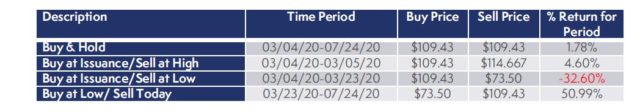

- Munis -sleepy quiet trading investments? Not all of them! Some high yield “stressed” sectors displayed equity type price movements during the recent COVID meltdown. Highlighted below is the trading performance for Buckeye Tobacco Settlement bonds (non-rated, backed by taxes on cigarettes, 5% coupon with a 6/01/2055 maturity date). An investor owning this bond could have come out even, be up 51% or down 32%. Does this look like any stocks you know?

- Much of the commentary from the muni analyst world remains constructive. PIMCO is recommending investors buy long-dated munis. JP Morgan thinks the only thing that could set back munis back now is if the fourth stimulus package is not passed. This is being offset by headlines such as “Las Vegas in a world of hurt”, “NYC losing almost $600 million in parking revenue”, “Tax revenues down $191 billion versus budgeted levels for 2020/2021”. Seems a bit of a mixed message to us at MainLine.

The Eye of the COVID-19 Muni Storm

Eye of the Storm:

a region of calmer weather found at the center of a strong tropical storm.

The Eye of the Muni Storm:

The calm and denying nature of muni prices while at the center of an economic and health crisis.

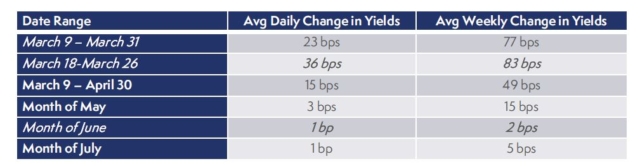

Instead of measuring the amount of rain and the force of the wind, a muni market storm can be measured by the daily and weekly change in interest rates. We are looking at volatility, so whether the change in rates is up or down, we measure it as absolute.

Below is a chart showing the force of the storm on the muni market using the bps change in the 15-year AAA:

As you can see above, the storm started blowing in early March, it reached its peak March 18 to 26th, and then has slowly moved on, at a spot now where there is no real volatility. Currently, rates seem content to stay where they are with a slow grind lower. Things are calm and perception appears to be no economic or health concerns. MainLine feels munis are in the Eye of the COVID-19 storm.

Why do we feel there is the second half of the storm to come?

There are three concerns MainLine has as we approach the fall of 2020:

- Current and future economic fallout due to the COVID becomes better quantified, impacting credit quality.

- The 2020 Election. Munis do not like politics, surprise and uncertainty.

- Seasonal supply & demand dynamics.

MainLine does not think the second half will be as strong as the first half. As storms move forward over land, they do tend to weaken. The muni market has had a chance to see the impact of the COVID-19, so there is not as much “unknown”. It has also set benchmarks and “resistant” levels from the first go around. The market knows more where the buying appetite is. MainLine is expecting the force to be strong enough to cause some price weakness and value opportunities. Let us take a closer look at the concerns we have.

Economic Fallout and its impact on Credit Quality:

As we detailed in our May 2020 Monthly Credit Review, the lockdown and current economic fallout has left a big hole in state and local government budgets. To date, S&P has only downgraded 26 municipal issuers due to COVID, but have put 1,167 on negative outlook. We expect more upcoming downgrades, as estimates of tax revenues lost are revised. Current estimates from the Tax Foundation (due to COVID) for 2020 & 2021 compared to 2019 are as follows:

- Sales tax revenue on average down 7%

- Income Tax revenue declines of roughly 9%

- Corporate income tax revenues down 28%

This represents a decline of $121 billion versus 2019 and $191 versus what was budgeted for 2020-2021. Originally, Moody’s had estimated $274 billion versus 2019. Either way, Federal aid will be needed, along with tax/fee increases and cuts in services and employees. If D.C. wants to ensure the economy recovers, they best take care of the public sector. Otherwise, aid to anyone or anything else will be muted.

Election 2020:

The muni market’s post-election return record is mixed and depends less on the winning party and more on policy certainties and the impact on munis. This year could be interesting as the process itself and could be just as important. Political tension, protests, and evidence of voter fraud are all risks that could upset the capital markets. As we have learned from the COVID, in times of uncertainty, munis can act like the stock market. Below are the performance results of munis versus Treasuries the month leading up to the elections, and the month after (October and November):

The Trump election in 2016 surprised and initially scared the market. The election of Obama saw munis underperform, but this was also during the banking crisis, which was the main reason for the poor performance. What we can derive is: economic and policy uncertainties lead to muni underperformance more than if the president is a Democratic or a Republican.These are uncertain times in politics and the economy.

Seasonal Supply & Demand Technicals:

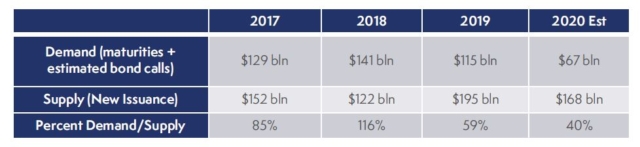

After a strong 3 months, supply and demand technicals are very weak going into the fall. This is the “seasonal norm” for munis. However, this year looks to be a little more lopsided.Below are the actual percentages of demand versus supply figures for the past three years, along with the 2020 estimate:

This chart shows that the muni market will need new cash allocations or new investors in munis to take on the additional supply left over, after the needs to replace maturing or called debt need are satisfied. The imbalance is significantly larger than in previous years. If the muni market is not perceived to be a safe-haven or great value (given credit and liquidity concerns), we will see a huge supply/demand disparity, which will cause yields to rise in order to entice buyers.

Conclusion:

Close up the windows, batten down the hatches, this muni market storm is not over. It may have lost some force, but current market conditions are too calm for the economic and political fallout still to come.

View the Monthly Report PDF here.

This document is for informational purposes only and is summary in nature. It does not contain all material information and considerations relevant to an investment in MainLine West Tax Advantaged Opportunity Fund IV LLC (“The Fund”). No representations or warranties express or implied, are made as to the accuracy or the completeness of the information contained herein. Any prior investment results presented herein are provided for illustrative purposes only and have not been verified by a third party. Further, any hypothetical or simulated performance results contained herein have inherent limitations and do not represent an actual performance record. Actual future performance will likely vary and June vary sharply from such hypothetical or simulated performance results. This document does not constitute an offer to invest in securities in the fund. No offer of securities in the fund can be made without delivery of The Fund’s confidential private placement memorandum and related offering materials. An investment in securities of The Fund involves risk, including potential risks that could lead to a loss of some, or all, of one’s capital investment. There is no assurance that the fund will achieve its investment objective. Past performance does not guarantee future results. There can be no possibility of profit without the risk of loss, including loss of one’s entire investment. There are interest and management fees associated with an investment in The Fund which are disclosed in The Fund’s offering materials.