February was a step back in performance by munis, which underperformed taxables. The increase in US Treasury rates finally pulled munis with it. MainLine feels this is a 30 to 60-day pause in muni outperformance in 2021. To further understand our view, we take the opportunity this month to explore how munis perform in a rising rate environment. In keeping with recent market concerns and investor anxiety, MainLine looks at what an increase in inflation could mean to the muni market. How will it affect its price performance and the potential impact on credit quality for the various issuers and sectors? Spoiler alert: the results may not be what you think they are.

Muni Market Review

February was a tough month for munis, giving back the year-to-date gains as US Treasuries finally pulled them up in yields. MainLine believes this is a 30 to 60 day pause, as munis remain primed for a good relative value year in 2021. Highlights from February’s performance are as follows:

- Muni yields were up 34 to 44 bps underperforming taxables, which were up 31 to 36 bps.

- Although the muni market struggled last month, year-to-date performance remains a small sample of how munis perform versus taxables in a increasing rate environment. Year-to-date comparisons show munis have increased less than their taxable equivalent by roughly 8.5 to 7 bps to every 10 bps increase in taxables.

- CDS spreads have tightened considerably since year-end, showing investors feel muni credit quality is getting stronger.

- The state average is at 49 versus 65 on 12/31/2020. • Biggest declines are from Illinois (44bps), Florida (27 bps), and New Jersey (23 bps).

- California and New York decreased marginally at 8 and 9 bps. MainLine feels this may be a quick window to get some cash to work and some income enhancement trades executed, while some current value has returned to the market. We are not sure if it will last 30 to 60 days, but it we do not think it will be long. It would be best to take advantage of it now if you have any 2021 plans to invest in the muni market.

Market News and Credit Update

The State of Minnesota’s (AAA/Aa1 ratings) plans to balance its 2021 budget is a good example of muni issuers ability to adapt to crisis and manage its ability to repay debt. The state has put forth a proposal to balance their COVID weakened budget by increasing income tax on the top income earners by 1%, use state budget reserves, transfer funds from the stadium reserve fund, and increase cigarette tax and issue debt. This encompasses three of the five pillars of confidence and strength in muni finance that MainLine adheres to.

The latest round of proposed stimulus includes at least $650 billion for funds for muni or muni-related sectors and provisions. In total, across the March 2020 CARES Act, the December 2020 stimulus and the new proposed package, it is estimated that $1.2 billion of muni-related provision aid will have been provided. If this latest proposal is approved, it is a big credit positive for munis.

The news that COVID has brought the financial end to big cities is a bit exaggerated. New York, San Francisco, Boston are cities that are suffering with declining real estate prices, but cities like San Diego, Phoenix, Seattle, Nashville, Austin, and Denver are up. On average, home prices from 2019 in cities increased 10.1% in December. People are looking to relocate to affordable and desirable cities and not wanting to give up the “city” lifestyle.

MainLine would like to thank the over 50 clients who joined us for our three zoom presentations. It was great to see most everyone and share our 2020 experiences and outlook for 2021. If you were unable to attend, we can provide you a link for the replay of the presentations upon an email request from you, and we have a written summary with charts available if that is your preference.

Municipals and Inflation: Beware?

Introduction: The markets are telling us that they are sniffing a scent of inflation in the future. The impact of the “easy money” from the various COVID stimulus plans, coupled with expected economic growth has caused the 10-year and 30-year US Treasury yields to increase 40 and 50 bps over the first 60 days of 2021 in anticipation of inflation finally returning. MainLine feels there could be a small increase but, in our Outlook 2021, we cited reasons why we feel inflation is not a big risk. Either way, we feel this is a good time to review the potential impact of inflation on the municipal market.

Background:

The assumption we are making for this analysis is that an increase in inflation expectations will increase interest rates for bonds maturing 10 years and out on the yield curve. Higher inflation means higher rates are needed to provide a nominal rate of return for fixed income investments. This affects the value and price of municipal bonds. Inflation can also have an impact on the expenses and revenues for municipalities that could then affect credit quality and, therefore, principal repayment protection. MainLine will review how municipal bonds have performed on a price basis in times of increasing rates, and review how inflation could impact credit quality for the various issuers and sectors.

Analysis: Impact on Municipal Returns and Relative Performance:

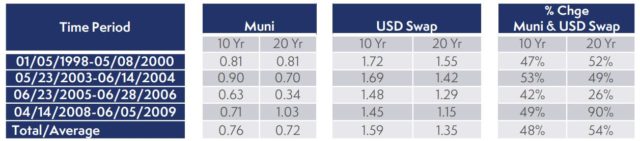

MainLine isolated five recent periods where interest rate went up over 100 bps for 10 and 20-year maturity yields. We focused on times when rates went up for longer than one year. This takes out any increase that caused a short-term disconnect, due to muni illiquidity. This seemed like a good set of criteria to highlight muni performance during a trend up in interest rates.

Analysis:

A change-up in yields will hurt the price on munis, but historically in a rising rate environment, munis outperform and prices are not hurt as much as other fixed income investments. On average, the five recent times above show that, for every 10 basis points increase in USD taxable swap rates, munis increase by roughly 5 basis points. This is half of the increase compared to taxable rates.

Why does this happen?

- Retail demand tends to increase at higher rates. This is because most investors are buying munis for the tax-exempt income and not for price appreciation. Higher rates mean more income. Therefore, munis become more attractive to investors.

- Issuance decreases as the ability to refund old debt and save money is more difficult and the higher borrowing costs lower the supply of new bonds, as municipalities pursue fewer new projects and those they do pursue require higher revenues to pay for them.

- It’s a math thing. As you do the calculation for the tax equivalent yields, a move up in tax-exempt rates does not have to be as high to equal a move up in taxable bonds. For example, a 50 basis points increase in tax-exempt rates equals an 88 basis points increase in tax-equivalent yield (represents the taxable bond yield) at 3% yield levels.

Impact of Inflation on Municipal Credit Quality:

As for sector and credit concerns, inflation implies higher prices and the impact on most muni sectors would be neutral to improved. For General Obligation debt issuers, it would improve as they receive increased tax revenues – more specifically, sales tax. Revenue bonds would be more neutral. Those providing an essential service with the ability to raise rates would pass the cost on to consumers as their costs increase. We would also see a decrease in housing bond issuance, as home sales would slow at higher mortgage rates, but this will not affect their credit quality. It would only slow down prepayments and extend the life on certain types of housing bonds. Issuers who have substantial outstanding variable rate debt could be adversely impacted. In practice, most muni issuers do not finance with a lot of short-term debt. This is an issuer-by-issuer concern, not necessarily a sector concern. One concern would be in the student loan sector. Higher education already faces some steep challenges going forward and the ability to raise tuition seems challenging. Along with this, add in the nature of floating rate student loans, there could be more worries. However, we do not participate in many student loan programs. The US Government, through their various programs, insures the few issues in which we have invested.

Conclusions:

As you can see, the impact of inflation on munis is not as one may initially think.

- Municipal bonds tend to outperform other fixed income investments in a rising rate environment

- Municipal credit quality, in general, improves.

- Municipal bonds are not the ideal inflation hedge investment, but it is good to know they also tend to hold up on a relative basis in that environment.

View the Monthly Review PDF here.

This document is for informational purposes only and is summary in nature. It does not contain all material information and considerations relevant to an investment in MainLine West Tax Advantaged Opportunity Fund IV LLC (“The Fund”). No representations or warranties express or implied, are made as to the accuracy or the completeness of the information contained herein. Any prior investment results presented herein are provided for illustrative purposes only and have not been verified by a third party. Further, any hypothetical or simulated performance results contained herein have inherent limitations and do not represent an actual performance record. Actual future performance will likely vary and June vary sharply from such hypothetical or simulated performance results. This document does not constitute an offer to invest in securities in the fund. No offer of securities in the fund can be made without delivery of The Fund’s confidential private placement memorandum and related offering materials. An investment in securities of The Fund involves risk, including potential risks that could lead to a loss of some, or all, of one’s capital investment. There is no assurance that the fund will achieve its investment objective. Past performance does not guarantee future results. There can be no possibility of profit without the risk of loss, including loss of one’s entire investment. There are interest and management fees associated with an investment in The Fund which are disclosed in The Fund’s offering materials.